The University Courses With The Highest Return On Investment

Back

Choosing a field of study at university is a significant decision. Beyond your passions and ambitions, there lies the practical consideration of return on investment (ROI). Is the cost of higher education worth the degree you’re pursuing? Will your future salary justify the expenses and time spent at university compared to entering the workforce directly? In today’s climate, where the cost of living is at record highs, these questions are more pertinent than ever.

Striking the right balance between passion and profit can be challenging. Should you prioritise a high-ROI course, or follow your heart knowing the financial returns might be more modest? Luckily, some degrees offer the best of both worlds. To explore this important decision, we analysed extensive public data and surveyed 1,000 students about their educational choices. A striking 72% of respondents believe they will achieve a positive ROI within five years of graduating. Here are our findings to help guide your decision.

Average university course earnings

Below is a snapshot of the lowest and highest paying university degrees, highlighting the average annual earnings of graduates in the UK.

| Subject | Avg. Earnings Year 1 | Avg. Earnings Year 5 |

|---|---|---|

| Medicine & Dentistry | £40,500 | £54,335 |

| Mathematical sciences | £31,978 | £54,328 |

| Business & management | £31,923 | £53,784 |

| General, applied & forensic sciences | £21,890 | £52,500 |

| Economics | £34,050 | £52,307 |

| Law | 23,585 | £49,428 |

| Engineering | £32,657 | £46,264 |

| Architecture, building & planning | £29,064 | £43,971 |

| Physics & Astronomy | £28,500 | £43,228 |

| Allied Health | £25,910 | £42,460 |

| Medical Sciences | £27,300 | £41,750 |

| Politics | £26,857 | £41,578 |

| Pharmacology, toxicology & pharmacy | £28,608 | £41,116 |

| Chemistry | £27,107 | £39,785 |

| Geography, earth & environmental studies | £25,757 | £39,364 |

| Materials & technology | £27,633 | £39,116 |

| Health & social care | £31,184 | £37,107 |

| Biosciences | £24,935 | £37,407 |

| Languages & area studies | £23,415 | £37,076 |

| Nursing & midwifery | £32,372 | £36,927 |

| History & archaeology | £22,564 | £36,750 |

| Philosophy & religious studies | £22,807 | £36,050 |

| IT/Computing | £24,053 | £34,730 |

| Veterinary sciences | £29,045 | £34,518 |

| Sociology, social policy and anthropology | £22,742 | £32,907 |

| Media, journalism & communications | £18,578 | £32,250 |

| English | £20,169 | £31,684 |

| Psychology | £19,457 | £31,635 |

| Education & Teaching | £25,078 | £31,364 |

| Agriculture, food & related studies | £24,930 | £30,850 |

| Combined & General Studies | £24,060 | £30,780 |

| Sport & exercise sciences | £18,969 | £28,835 |

| Performing arts | £17,071 | £28,507 |

| Creative Arts & Design | £17,800 | £27,385 |

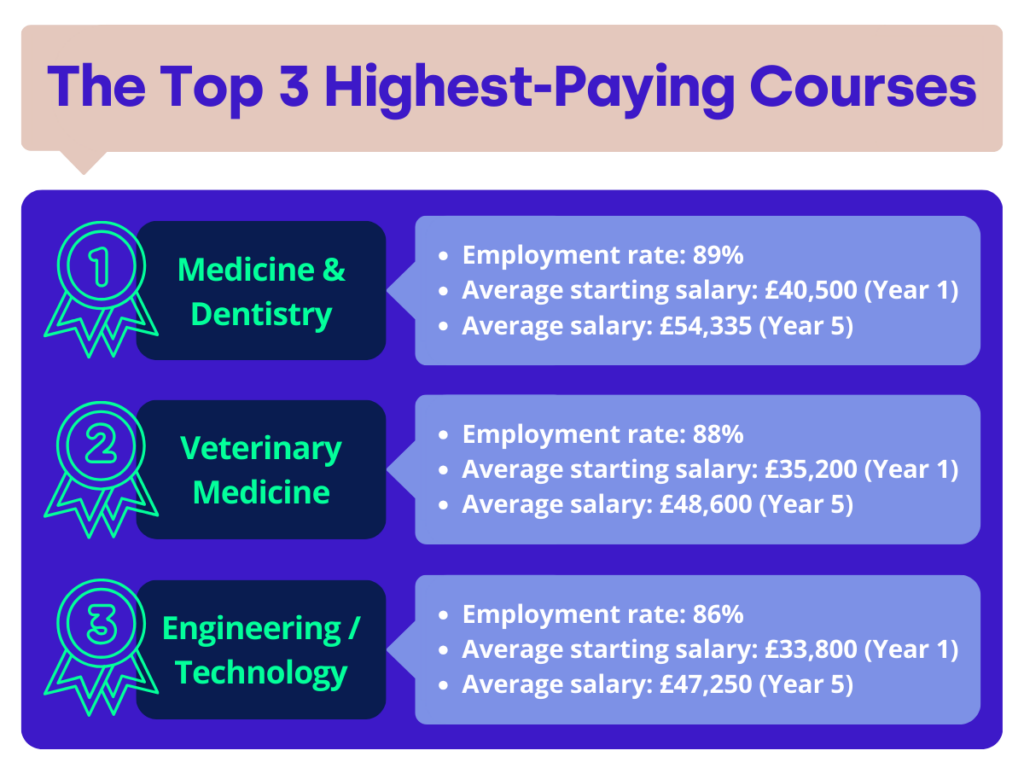

The Highest-Paying Course

It’s no surprise that medicine and dentistry are some of the highest paying university courses. With 12% of the students we surveyed studying health and medicine, it certainly is a top contender. Reported by 14 different universities, this course has an average employment rate of 89.3%, starting with an average salary of £40,500 in your first year and rising to an average of £54,335 by your fifth year. Medicine and dentistry are both five-year minimum courses, meaning that your minimum student loan would be £46,250, not inclusive of interest or any student loans taken out for maintenance and living costs. Students who go on to earn the average salary will have to pay off between 6% and 9% straight away, depending on their loan type, which is at least £2,430 per year. But for some, the benefit of helping those in need is just as rewarding as the financial benefit.

The Lowest-Paying Course

At the bottom of the table, but not to be overlooked, is creative arts, which 12% of the students we surveyed study. Unfortunately, the employment rate for this course is significantly lower at 85.5%, and an average salary of £17,800 in year one, rising to £27,385 in year five. If you decide to go this route, it’s unlikely that you will have to pay off your student loan, as this is only deducted once you hit an annual salary of £25,000 per annum. It’s also important to remember that it’s okay to follow your passion—it’s not all about the money that you make. In fact, 38% of our students reported that they are not sure that their field of study will provide a positive return on investment. But rewards come in all shapes and sizes. For example, you may find a creative job more relaxing, which is positive for your well-being. And, ultimately, you can decide the value of your artistic services, so freelance and commissions are great ways for you to express your talents and make the most of your course.

Passion vs Profit

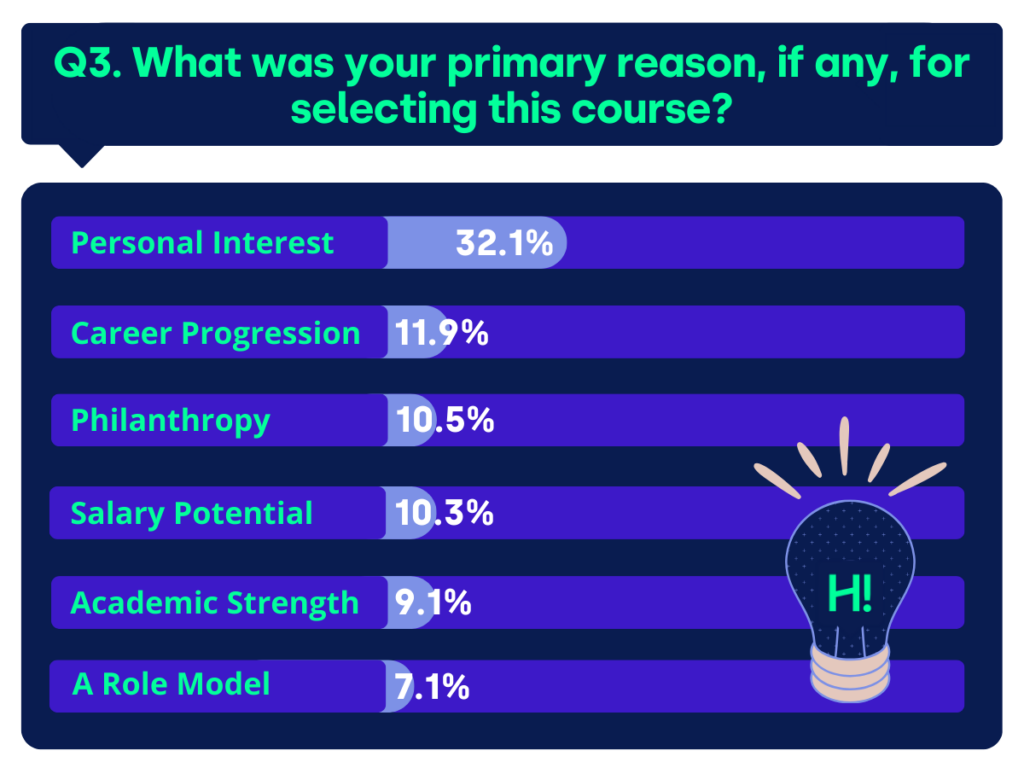

Above is a table showing some of the best university courses for careers in terms of their ROI. However, we can infer from the drastic difference between the graduate and enrollment figures that they have extremely high drop-out rates. The intense pressure of university life, combined with doubts about financial returns, can lead some students to abandon their studies. This highlights the importance of carefully weighing personal interests against financial considerations before committing to a degree. This further reinforces the idea that graduates in lower-paying fields often have a greater sense of purpose in their careers. Speaking on the subject, Chris Rea, Head of Strategic Relationships for Prospects at Jisc, said: “The majority of students who graduate from courses associated with lower returns agree that their jobs are meaningful and tend to be happy with their work-life balance.”

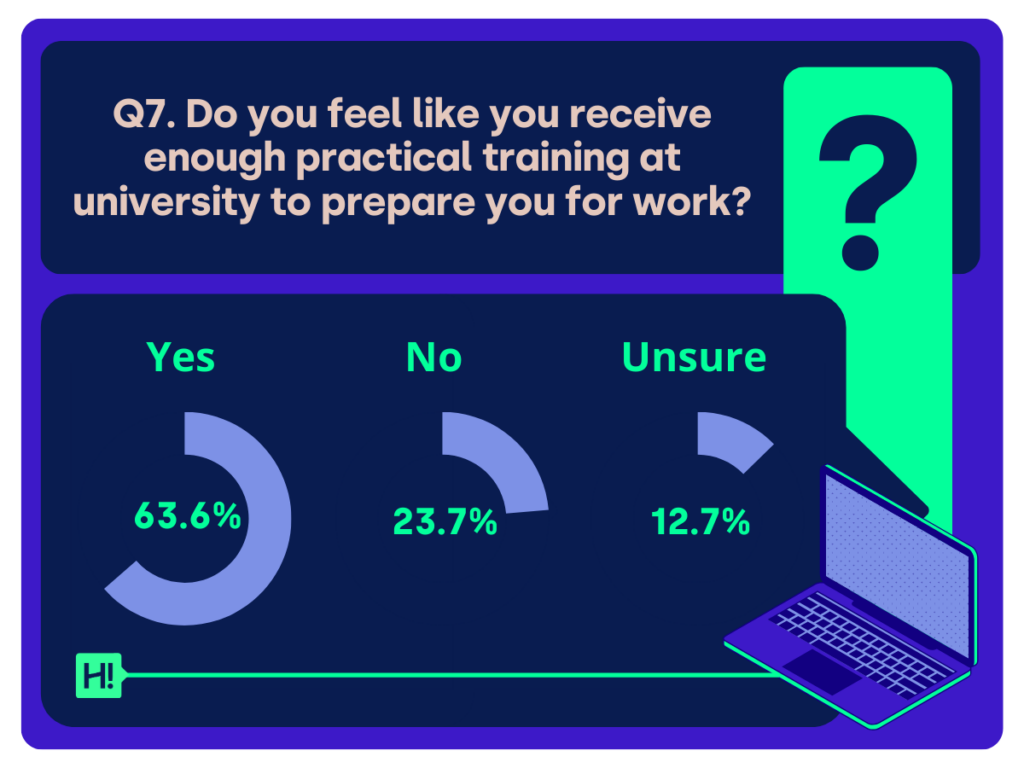

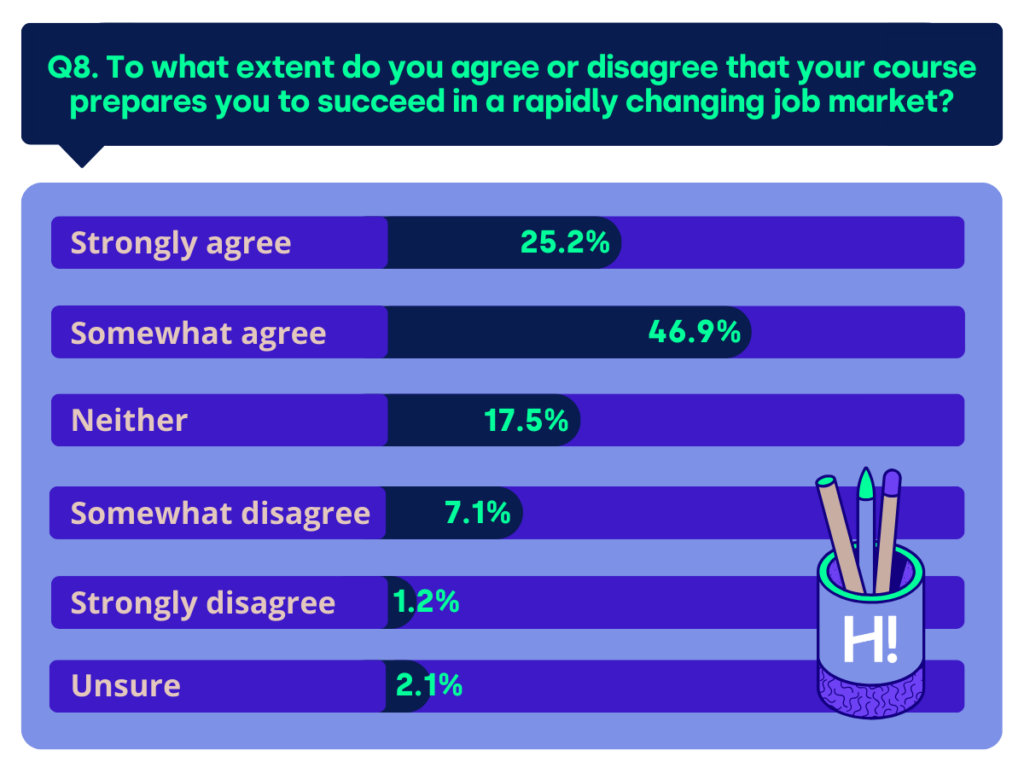

On the flip side, courses with high ROI are key to landing those dream salaries, as they give you the hands-on experience and expert knowledge that can really set you apart in your career. University is still a solid choice for many students, not just because it gets you ready for your job, but because it gives you the essential skills you’ll need in the real world. The best part? Universities focus on offering both academic learning and practical training. In fact, 64% of students in our survey said their university experience gave them enough practical skills to step straight into the workforce. That shows just how useful university can be when it comes to bridging the gap between what you learn in the classroom and what you’ll need on the job. Plus, 72% of students felt that university prepared them for the fast-paced, ever-changing job market, meaning you’ll be ready to tackle whatever challenges come your way. As industries evolve rapidly, the ability to learn, adapt, and think on your feet becomes super important – and universities are often the best place to build those skills. With degrees in areas like technology, engineering, business, and healthcare offering higher earning potential, investing in university is not just about landing a great job, but setting yourself up for long-term success and financial freedom.

Survey Results

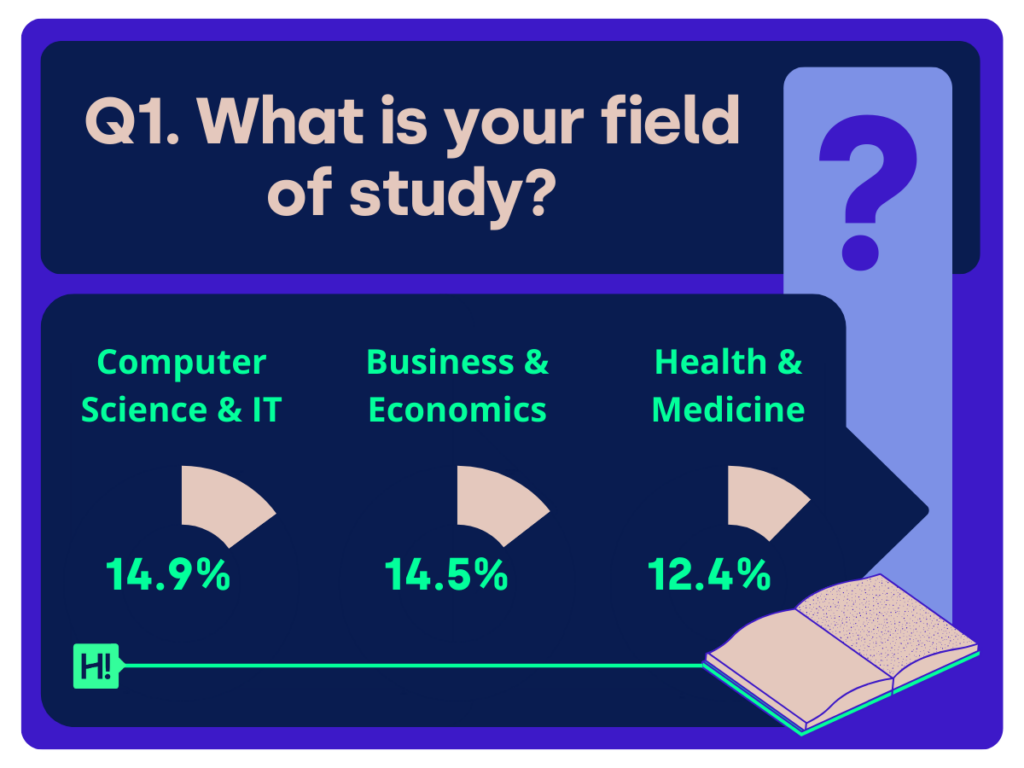

Q1: What is your field of study?

The survey included responses from students across diverse fields. Popular fields of study included sciences, arts, and business-related disciplines.

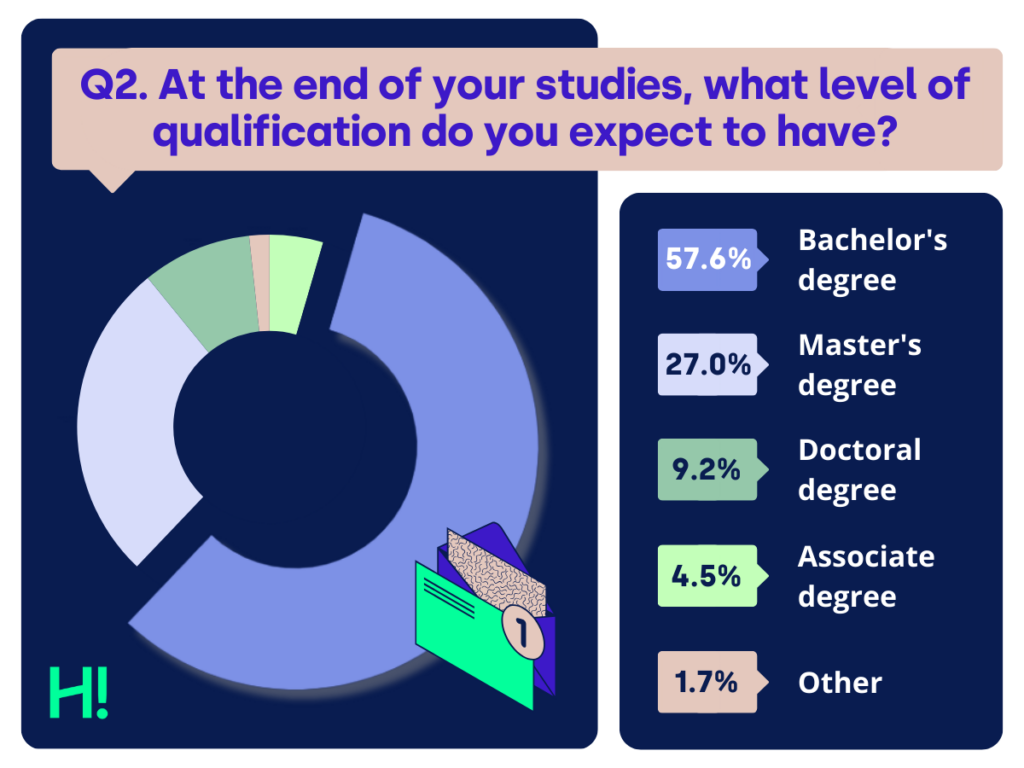

Q2: At the end of your studies, what level of qualification will you have?

The majority expected to achieve an undergraduate degree (BSc, BA), with a smaller percentage aiming for postgraduate qualifications (Masters, PhD).

Q3: What was your primary reason, if any, for choosing your current field of study?

Key reasons included passion for the subject, future career prospects, and parental influence.

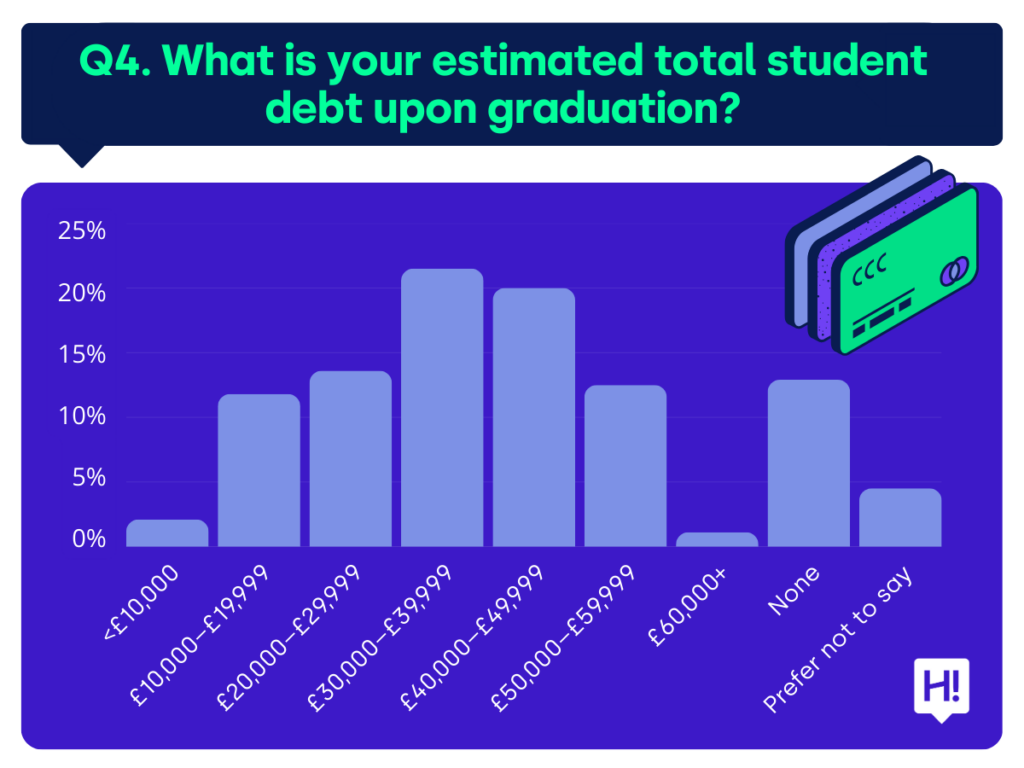

Q4: What is your estimated total student debt upon graduation?

Estimated debt levels varied, with a significant proportion expecting debt under £30,000, but some estimating higher ranges up to £50,000 or more.

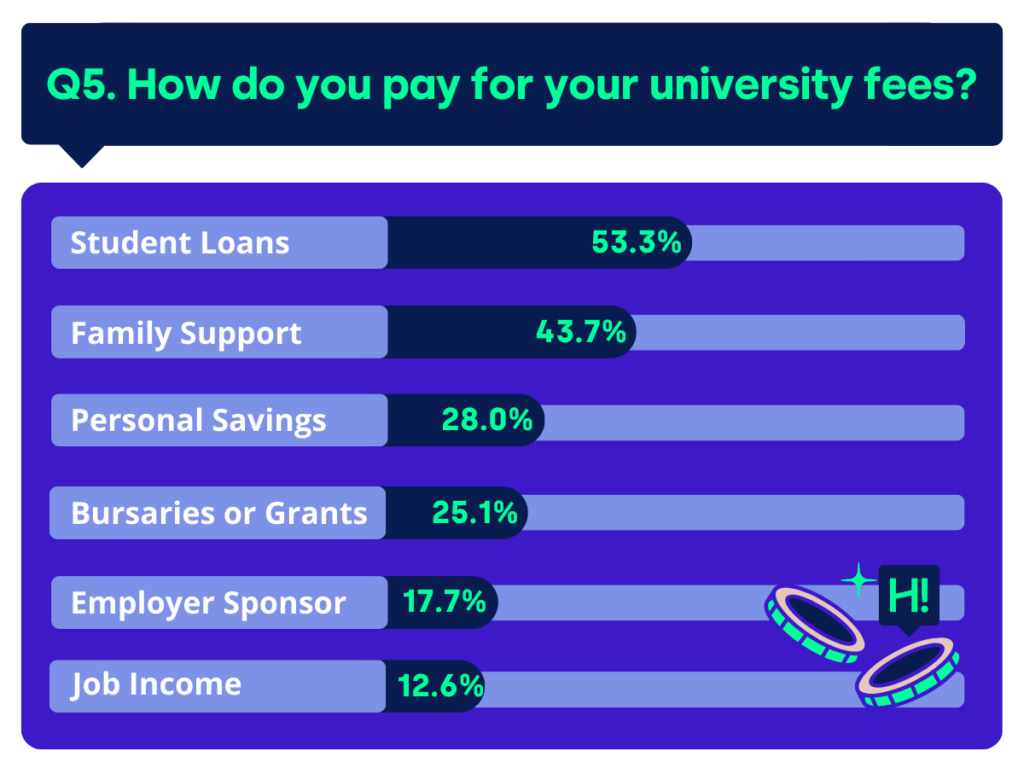

Q5: How do you pay for your university fees?

Most students relied on student loans, followed by family support and personal savings. Scholarships and grants were less common but still significant.

Q6: What is the highest annual income you expect to earn after graduation?

Expected annual income post-graduation ranged from £21,000 to £60,000, with a smaller group anticipating higher salaries.

Q7: Do you feel like you receive enough practical experience as part of your degree?

63.6% of respondents felt they received enough practical experience during their studies, with regional differences in perception.

Q8: To what extent do you agree or disagree that your university experience has prepared you for your future career?

72% agreed that their university experience prepared them for future careers, though opinions varied on specific skill readiness.

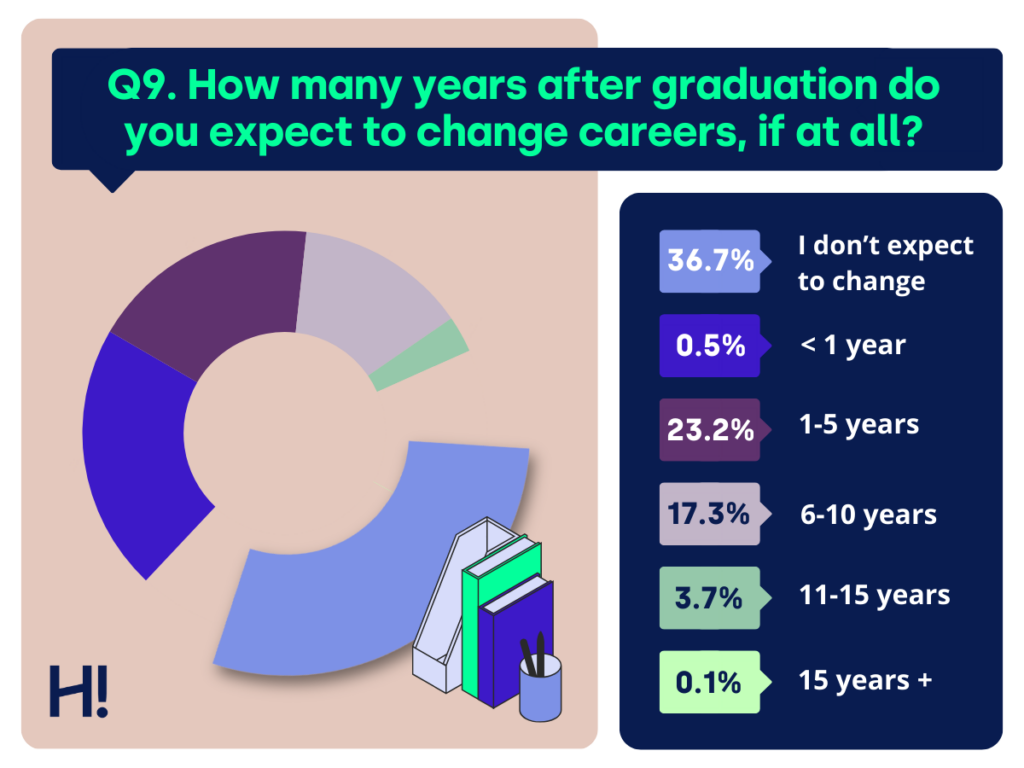

Q9: How many years after graduation do you expect it will take to pay off your student debt?

23% expected to repay debts within 5 years post-graduation, while others estimated longer timelines or none due to career choice or debt forgiveness.

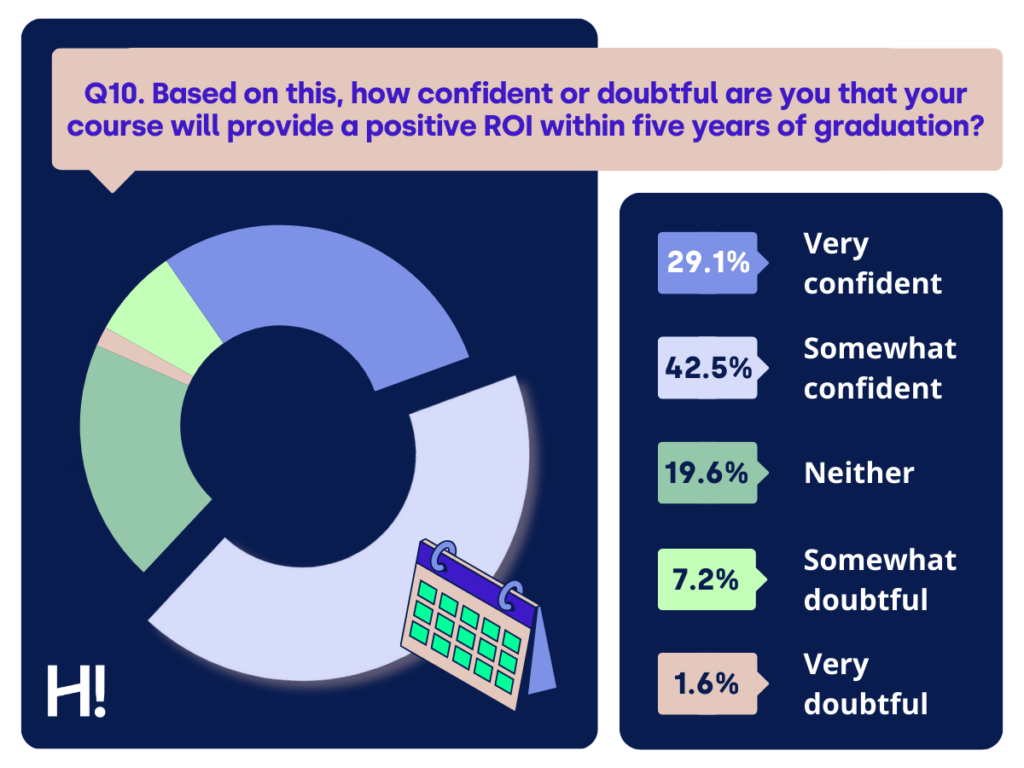

Q10: Based on this, how confident or doubtful are you about your future career prospects?

72% of students felt confident about their career prospects, with 29% very confident and 43% somewhat confident.

University isn’t the right path for everyone, especially when it comes to lower-paying degrees like creative arts and humanities. The Return on investment university courses provide doesn’t determine whether or not you are “successful”. However, for many careers, a degree is essential and serves as an invaluable addition to a CV. Beyond financial returns, university equips students with the skills, knowledge, and resilience needed to thrive in an ever-changing world. No matter what, trust the decision you make—after all, nothing quite beats the experiences you’ll have at uni both academically and socially!

So, if you’ve decided that university is the right choice for you, the next question is which one? With student housing up and down the country, you can be sure that Here! Students will provide exceptional student accommodation to help you on your journey.

Methodology

In collaboration with Censuswide, we conducted research which surveyed 1,000 students living in the UK. The survey was completed by people who identify as men, women and non-binary from across the country to ensure unbiased results.

To download the full results of the survey, click here.